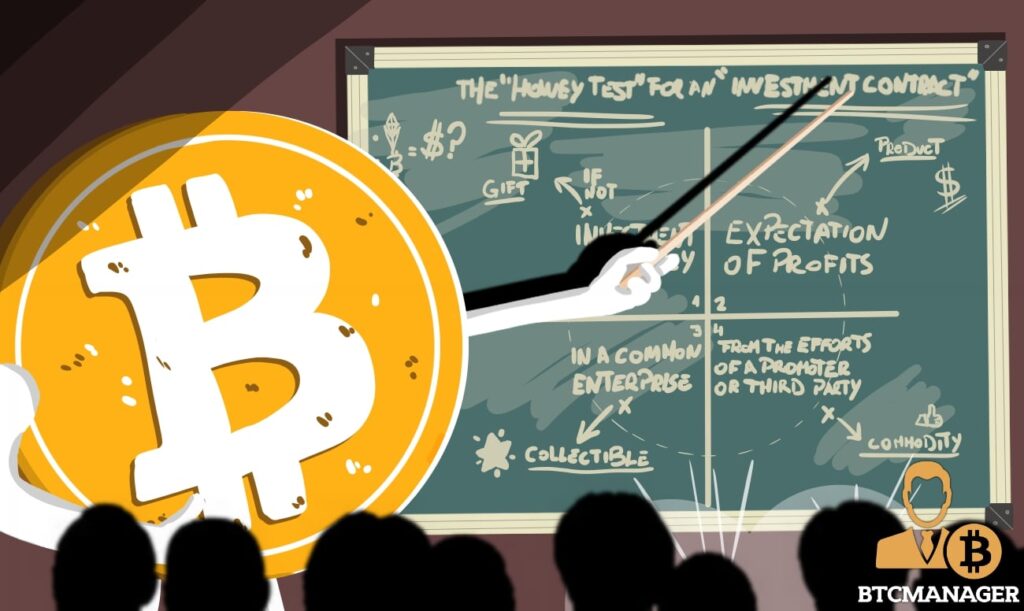

What Are The Howey Test And Its Implications For Cryptocurrency?

The Howey test is a legal test used to determine whether an investment is considered a security under U.S. securities laws. It was established by the U.S. Supreme Court in 1946 in the case of Securities and Exchange Commission v. W.J. Howey Co..

The Howey test consists of four elements

-

Investment of money: The investor must make an investment of money in the enterprise. This could include cash, property, or other valuable assets.

-

Common enterprise: The investor must be investing in a common enterprise. This means that the investor’s profits are not solely dependent on their own efforts, but rather on the efforts of others.

-

Reasonable expectation of profits: The investor must have a reasonable expectation of profits from the investment. This means that the investor expects to make a return on their investment, and that this return will come from the efforts of others.

-

Derived from the efforts of others: The investor’s profits must be derived from the efforts of others. This means that the investor is not solely responsible for generating profits from the investment.

If an investment meets all four of these elements, then it is considered a security under U.S. securities laws. This means that the investment is subject to certain regulations, including registration with the Securities and Exchange Commission (SEC) and disclosure requirements.

ALSO READ: How To Host A Decentralized Website

The Howey test has been applied to a wide variety of investments, including stocks, bonds, options, and even some digital assets. The SEC uses the Howey test to determine whether an investment is a security and whether it should be regulated under U.S. securities laws.

Here are some examples of how the Howey test has been applied:

-

Stocks: Stocks are generally considered securities because they meet all four elements of the Howey test. Investors invest money in a company with the expectation of profits that will be derived from the efforts of the company’s management and employees.

-

Bonds: Bonds are also generally considered securities because they meet all four elements of the Howey test. Investors invest money in a company or government with the expectation of receiving interest payments that will be derived from the company’s or government’s ability to repay the loan.

-

Options: Options are generally considered securities because they meet all four elements of the Howey test. Investors invest money in the right to buy or sell an underlying asset with the expectation of profits that will be derived from the price movements of the underlying asset.

-

Digital assets: Some digital assets, such as utility tokens, may be considered securities if they meet the Howey test. However, other digital assets, such as Bitcoin, are not considered securities because they do not meet all four elements of the Howey test.

The Howey test is an important tool for protecting investors and ensuring that securities markets are fair and efficient.

Compliance with federal securities laws: What cryptocurrency companies need to know

As the cryptocurrency industry continues to evolve, regulators are increasingly focused on ensuring that cryptocurrency companies comply with federal securities laws. This is because many cryptocurrencies are considered securities under the law, and cryptocurrency companies may engage in activities that could be considered securities offerings or sales.

What are federal securities laws?

Federal securities laws are a body of laws that are designed to protect investors from fraud and manipulation. These laws are administered by the Securities and Exchange Commission (SEC), which is an independent agency of the U.S. government.

Which cryptocurrency companies need to comply with federal securities laws?

Any cryptocurrency company that offers or sells securities, or that engages in activities that could be considered securities offerings or sales, needs to comply with federal securities laws. This includes cryptocurrency exchanges, broker-dealers, investment funds, and issuers of cryptocurrency tokens.

What are the key compliance requirements for cryptocurrency companies?

The key compliance requirements for cryptocurrency companies depend on the specific activities that the company is engaged in. However, some of the general compliance requirements include:

- Registration: Cryptocurrency companies that offer or sell securities may need to register with the SEC.

- Anti-fraud provisions: Cryptocurrency companies must comply with anti-fraud provisions of the federal securities laws. This means that they must not make false or misleading statements about their products or services.

- Know-your-customer (KYC) and anti-money laundering (AML) programs: Cryptocurrency companies must implement KYC and AML programs to identify and verify their customers and to prevent money laundering and terrorist financing.

- Cybersecurity: Cryptocurrency companies must implement strong cybersecurity measures to protect their customers’ data and assets.

What are the penalties for non-compliance?

The penalties for non-compliance with federal securities laws can be severe. These penalties can include civil penalties, criminal penalties, and injunctive relief.

How can cryptocurrency companies stay compliant?

There are a number of steps that cryptocurrency companies can take to stay compliant with federal securities laws. These steps include:

- Consulting with an attorney: Cryptocurrency companies should consult with an attorney to get legal advice on their specific compliance obligations.

- Implementing a compliance program: Cryptocurrency companies should implement a compliance program that is tailored to their specific business.

- Training employees: Cryptocurrency companies should train their employees on their compliance obligations.

- Monitor compliance: Cryptocurrency companies should monitor their compliance on an ongoing basis.

What are the risks of non-compliance?

The risks of non-compliance with federal securities laws are significant. These risks include:

- Regulatory enforcement actions: Cryptocurrency companies that are found to be in violation of federal securities laws may be subject to regulatory enforcement actions by the SEC. These actions can include fines, cease-and-desist orders, and even criminal charges.

- Reputational damage: Non-compliance with federal securities laws can also damage the reputation of a cryptocurrency company. This can make it difficult to attract new customers and partners.

- Loss of investor confidence: Non-compliance with federal securities laws can also erode investor confidence in a cryptocurrency company. This can lead to a decline in the value of the company’s cryptocurrency tokens.

Additional compliance considerations

In addition to the general compliance requirements discussed above, cryptocurrency companies should also be aware of the following additional considerations:

- The SEC has taken a number of enforcement actions against cryptocurrency companies in recent years. This suggests that the SEC is increasingly focused on regulating the cryptocurrency industry.

- The SEC has issued a number of guidance documents on how the federal securities laws apply to cryptocurrencies. These guidance documents can be a helpful resource for cryptocurrency companies.

- The SEC is currently considering whether to propose new rules that would specifically address the cryptocurrency industry. Cryptocurrency companies should stay informed about these developments.

Conclusion

Complying with federal securities laws is a complex and ever-changing challenge for cryptocurrency companies. However, it is essential for cryptocurrency companies to comply with these laws in order to avoid regulatory enforcement actions, reputational damage, and loss of investor confidence.